Sydney Financial Advisors believe that your future is created by what you do today, not tomorrow. Regardless of what stage of life you’re at, sound financial planning is the foundation required on which to build the tomorrows you’re after.

The Financial Planning Process

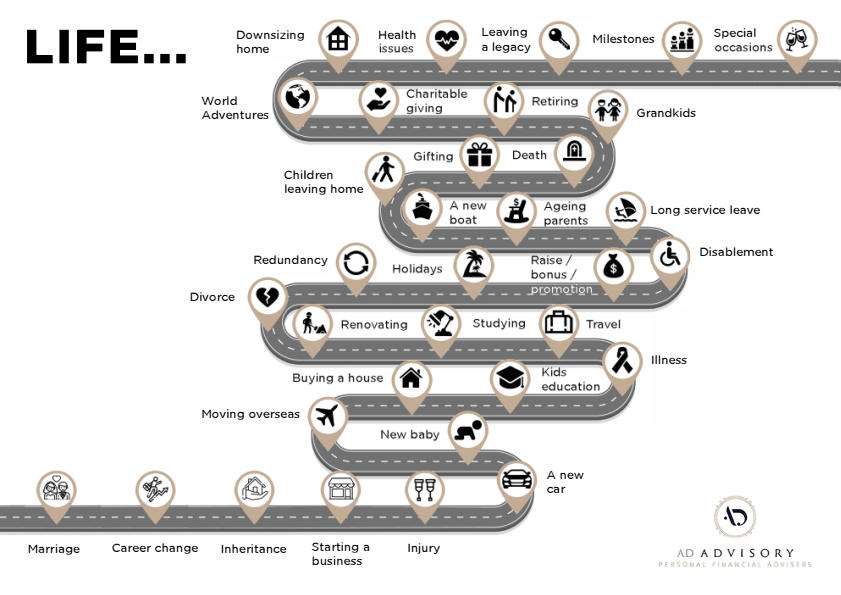

Whether your goals are to own numerous investment properties, pay off your mortgage, retire early, buy a new car or boat, create a passive income stream, travel the world, invest in a new business, or simply live debt-free, we want your financial future to be as bright as possible.

It is this philosophy that drives us to offer a full complement of financial services designed to turn all of your financial goals into realities. The scope of these services include:

- Investment Planning

- Personal Risk Management and Insurance Planning

- Superannuation and SMSF

- Retirement Planning (Free eBook)

- Estate Planning (Free eBook)

We partner with you to create a customised financial plan that ascertains your current financial situation, sets goals for the future and identifies the strategies required to accomplish them.

What is Financial Planning?

Financial planning services help you develop strategies to reach your financial goals. Planners help you to get the most from your money, avoid making expensive mistakes, safeguard your assets, take more control over your finances, plan for retirement and achieve all your financial goals and ambitions.

Why Do I Need A Financial Advisor?

Financial advisors are helpful because they help you put together a comfortable, financially secure future for you and your loved ones. Advisors look at your short-term, medium-term, and long-term financial goals and create personalised financial plans to help you reach those goals.

Please don’t think you need to already be in financial trouble before you can see an advisor. You also don’t have to be rich to benefit from talking to one. You should talk to financial planners in Sydney if you are hoping to get more out of your money. Financial planning is more about your goals rather than your financial situation.

Advisors are particularly helpful to the self-employed, those planning retirement or having a baby, and those with a lot of money or assets they want to be protected.

How To Find A Financial Advisor

The first thing to do when finding a financial advisor is to check their qualifications. The right financial advisor has all the necessary qualifications and meets the training standards of the Australian Securities and Investment Commission. These standards are set in the Regulatory Guide 146 Licensing: Training of Financial Product Advisors. You can check your financial planner's qualifications by typing there name here https://moneysmart.gov.au/financial-advice/financial-advisers-register

When you check the financial planner's qualifications also check the areas they are licensed to provide advice in, not all financial planners are able to provide advice in all areas that you may require advice in.

Check to see whether they have specialist qualifications or hold specialist designations. For example, if you are seeking advice for self-managed super funds see that they have the appropriate qualification in that area or hold a specialist designation like the Self Managed Super Fund Association’s SSA designation which requires additional education and exam to qualify and maintain the qualification

You should only choose financial planners who are licensed and authorised by the Australian Securities Investment commission and who hold either an Australian Financial Services License – or are an authorised representative of one such licensee.

What Happens When You Meet a Sydney Financial Advisor?

The financial planning process is split into five distinct stages;

Here is a good place to start and what to expect https://static.moneysmart.gov.au/files/publications/financial-advice-and-you.pdf

1. Discovery – The First Meeting

The first meeting is the discovery part of the process. We take this chance to learn as much as possible about your personal circumstances, financial situation, needs, goals and objectives This will give us an insight into what your personal values are and what your goals you hope to achieve and so we can ascertain whether we have the competence to provide you with the service you require.

2. Research

If we both determine that our values are aligned and we can work towards a long term mutually beneficially relationship and we can add value to your life and financial goals with our services and help, we’ll start the research process to develop a personalized financial plan to meet your requirements, goals, needs and personal objectives. Our plans are purpose-built around you and include advice like how to create a tailored financial strategy to meet your needs, goals and objectives.

3. Approval

Once the financial strategy is agreed upon, we will have another meeting with you to go over the plan and recommendations and how they benefit you, improve your personal circumstances, meet your needs goals and objectives, including all costs, risks associated with the proposed plans as well as any alternative options, and risks including not doing anything. We will give you our recommendations in writing in the legal form required called the Statement of Advice (SoA).

When you fully understand all benefits, costs and risks associated with the strategy and product and you are confident the proposed plans incorporated your personal circumstances and are likely to meet your intended needs, goals, and objectives, you will need to sign the Authority to proceed so we can progress towards implementing the agreed financial strategies.

4. Implementation

As soon as you provide us with the authority to proceed, we will begin implementing the recommendation, this could take a few weeks or months depending on the complexity of your strategy whether that be implementing a risk plan, investment plan, or complex estate planning strategy that requires the assistance of other professionals such as your lawyer or estate planning practitioners.

5. Review and Update Plan

The only thing in life that is certain is change. Your financial plan is a living document that needs to be regularly reviewed so that It remains relevant to your personal circumstances, needs, goals and objectives.

We offer regular annual reviews as a minimum (and more frequent reviews may be required depending on the complexity of your situation and plans) so that we can update your plans and make the necessary adjustments on an ongoing basis, so they give effect to your intended goals and objectives. This may include monitoring your investments to ensure they remain aligned to your goals, monitoring changes in legislation and planning in the event of milestones such as marriage, children or passing of a loved one.

business owners

- Understanding the financial implications of your business structure

- Cash flow management

- Keeping your business and personal finances separate

- Setting aside money for tax

- Planning for retirement and more